http://www.denhamspringsappraisers.com/ – How to Respond to Denham Springs Appraisals That Miss the Mark

Today’s NATIONAL ASSOCIATION OF REALTORS® Newsletter included a Snippet from a James Hagerty The Wall Street Journal article with the title, “How To Respond To Appraisals That Miss The Mark”. A snippet of the article is below:

“What can be done if a home appraisal comes in dramatically lower than the agreed-upon sale price?

Lenders will consider an appeal, but sellers must provide them with evidence.

Start by examining the appraisal carefully for errors. If the appraiser missed one of the bathrooms, miscalculated the square footage, or didn’t note the garage, the seller has grounds for an appeal.

Look at the comparables: Is the home used as a comparison in a different and more challenged school district? Is the comparable next door to something undesirable? If possible, pull some more realistic comps.”

Here’s Bill Cobb’s Appraiser Tips On Assisting The Home Appraiser To Not “Miss The Mark”.

1.) Give Appraiser The Basics. When the appraiser’s office calls to setup your appraisal inspection appointment, fill them in with the basics about your home – living area size, age, # bedrooms & bathrooms, lot size and any major renovations. This will help the appraiser to pull their “comps” (homes comparable to your home) from MLS prior to the appointment. This will also allow the appraiser to drive by the comps pulled to see if they are actually comparable to your home or not. It is a USPAP (Uniform Standards Of Professional Appraisal Practice) requirement for appraisers to physically drive by the comparable sales they use in their appraisal reports.

2.) MOST IMPORTANT. Type Out An Itemized List Of All Updates, Renovations and Mechanical Improvements within the past 5-10 years along with cost estimates for each item and present this list to the appraiser. This will provide the appraiser with a clear understanding of your investment into your home and will allow them to scan in this list into their appraisal report for documentation reasoning. If the appraiser makes a +25,000 adjustment for your home’s superior condition, then the scanned in list will help the mortgage underwriter understand why the appraiser applied the adjustment and why the adjustment is supportable in the market.

BUILDING PERMITS. It’s become most common for the lenders to require the appraisers to verify IF a building permit was issued for a major renovation and/or addition. If you’ve completed a major project where there was a building permit involved, have that out of the appraiser. Actually, a copy for the appraiser to scan into their report would be a better recommendation.

3.) Site Plans. Present the appraiser a copy of (to take with them) your plat map or site plan with lot dimensions, if you still have such.

4.) Interior Photos. Don’t be surprised when the appraiser begins to take interior photos of your home. In Today’s Mortgage Market, especially after the mortgage meltdown, mortgage lenders are requiring appraisers to provide interior photos of homes appraised. Be prepared for this. While your home doesn’t need to be spotless, it does need to be clean and well organized. As professionally as I can state this, the homes where there’s junk in the yard and the interior is filthy (carpets stained, etc.) in disaray don’t appraise as high as a well maintained home.

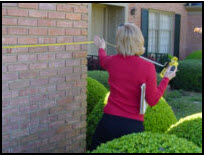

5.) DON’T Provide The Appraiser With The Previous Sketch From An Old Appraisal Or The House Plan, Make Them Physically Measure Your Home! After reviewing some older sketches provided by homeowner, I do see mistakes, discrepancies and sometimes wonder if the last appraiser was even measuring the same home. And, during construction, changes take place, walls are moved and the living area either increases or decreases. It’s been my experience over the past 17 years that a physical home measurement can result in a size between 10 sq. ft. to over 100 sq. ft. larger than the original house plan stated. At a time when homes are selling above $100/sf in many local markets, this is a BIG DEAL.

AND, SAME THING IF YOU LIST YOUR HOME. You should expect the exact same professional practice from the Realtor listing your home – that the agent actually physically measure your home. Think about this. In the listing transaction, you will generally pay 6% commission. If your home is $250,000, then you’ll pay $15,000 to have your home sold. It’s crucial that at the time your home listing hits the MLS for all 2700 local real estate professionals to view, that the living area is accurate, especially now that homes are selling above $100/sf in many local markets. A 100sf error could mean the loss of $10,000 for the seller. There have been occasions I’ve appraised homes under contract where the home wasn’t even measured prior to listing, the home was significantly smaller in living area size, the home didn’t appraise for the purchase price and the purchase agreement had to be re-negotiated. If your Realtor or their assistant doesn’t physically measure your home during the listing appointment, there’s major cause for concern. When interviewing an agent to list your home, my recommendation is to only list with an agent that will physically measure your home, provide a sketch showing you the accurate living area of your home and an agent that won’t rely on any previous listings data of your home in the MLS – the MLS History goes back to 1997.

Making Sure The Appraiser Doesn’t Miss The Mark Does Require Some Effort On The Homeowner’s Part. No one knows your home better than you do and the appraiser didn’t write the checks for the updates and renovations you may have possibly made. Help the appraisers not miss the mark by providing these recommendations above.

Bill Cobb is a Louisiana State Certified Residential Appraiser operating as Accurate Valuations Group in the Denham Springs / Livingston Parish Market. Bill has 17 years experience as a residential appraiser and carries on the family appraisal career tradition as a third generation appraiser. To learn more about AVG, see: http://www.batonrougerealestateappraisers.net/